Inhabitant Tax Information

This letter contains important information about 【Filing Inhabitant Tax】.

Filing Inhabitant Tax is required by law.

However, there are cases where you do not need to file for Inhabitant Tax.

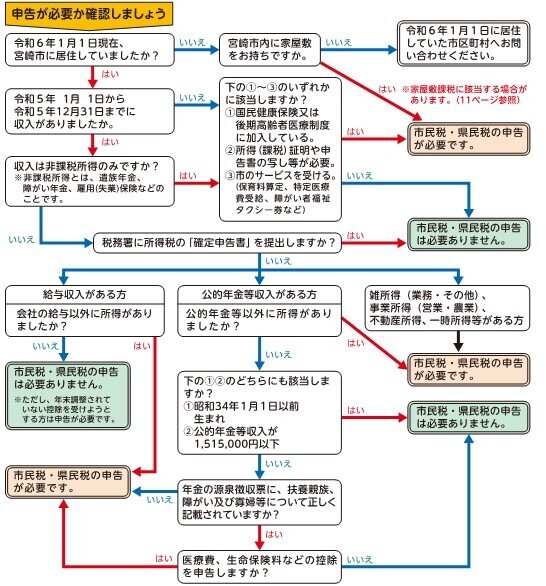

Please use the flowchart below to check whether or not you are required to file for Inhabitant Tax.

Please file by 【※7 March 2025】.

Even if you are a foreign citizen, if you live in Japan and have a certain amount of income, you are obligated to pay Inhabitant Tax.

If either of the following applies to you, you are required to file for Inhabitant Tax by filing an Inhabitant Tax Return.

・You received income other than your employment income or public pension from 1 January 2024 to 31 December 2024.

・You are enrolled in the National Health Insurance Program or Latter-Stage Elderly Medical Care System.

For more details, use the flowchart to check!

1 How to Check

Use the flowchart to check whether or not you are required to file for Inhabitant Tax.

< Flowchart >

〇Multilingual Versions

2 How to File Inhabitant Tax Return

|

Mail or bring to Income Tax Division |

Use the Miyazaki City Smart Application System |

Email or fax |

| 〇 | 〇 | × |

【Address】

Miyazaki City Income Tax Division

〒880-8505 1-1-1 Tachibanadori-nishi, Miyazaki-shi, Miyazaki-ken

3 Deadline

For those who are required to file an Inhabitant Tax Return, please submit the form by 【※7 March 2025】.

4 Inhabitant Tax Return Preparation Assistance System

Use the "Inhabitant Tax Return Preparation Assistance System" to prepare your Inhabitant Tax or National Health Insurance Tax Returns using your computer, smartphone, etc.

[Inhabitant Tax Return Preparation Assistance System]

【Not available now】https://miyazakishi-websinkoku.lgapo.jp/2024/

【How to Use】

| ・「All Pages」 |

( English / Chinese / Korean / Easy Japanese ) |

|

・「About the Inhabitant Tax Return Preparation Assistance System」 |

( English / Chinese / Korean / Easy Japanese ) |

| ・「1 Personal Information」 | ( English / Chinese / Korean / Easy Japanese ) |

| ・「2 Employment Income, Public Pension, etc.」 | ( English / Chinese / Korean / Easy Japanese ) |

| ・「3 Business Income & Other」 | ( English / Chinese / Korean / Easy Japanese ) |

| ・「4 Income Deductions & Tax Credits」 | ( English / Chinese / Korean / Easy Japanese ) |

| ・「5 Deductions for Dependents & Family Employees」 | ( English / Chinese / Korean / Easy Japanese ) |

5 E-Mail Consultation

If you do not know whether or not you are required to file for Inhabitant Tax, what documents are required, etc., you can consult the Income Tax Division by e-mail. (※Japanese, English, Chinese, and Korean Support Available)

<Contact US>

E-Mail :[email protected]

(※It may take some time to reply. Please consult as early as possible.)

6 About Japan's Taxes

If you would like to know more about Japan's taxes, please visit the links below.

・English:(https://www.city.miyazaki.miyazaki.jp/en/daily_life/tax.html)

・Chinese:(https://www.city.miyazaki.miyazaki.jp/cn/daily_life/zeikin.html)

・Korean:(https://www.city.miyazaki.miyazaki.jp/kr/daily_life/tax.html)

・Easy Japanese:(https://www.city.miyazaki.miyazaki.jp/easy/daily_life/tax.html)